Harnessing Predictive Insights in Real Estate

Our team finds one of the most exhilarating aspects of the real estate market to be monitoring market updates and trends. At the heart of this strategy and approach is to forecast of upcoming trends. But we don’t just speculate; we provide predictions backed by market signals and confirmation.

Analysing the Current Market Trends

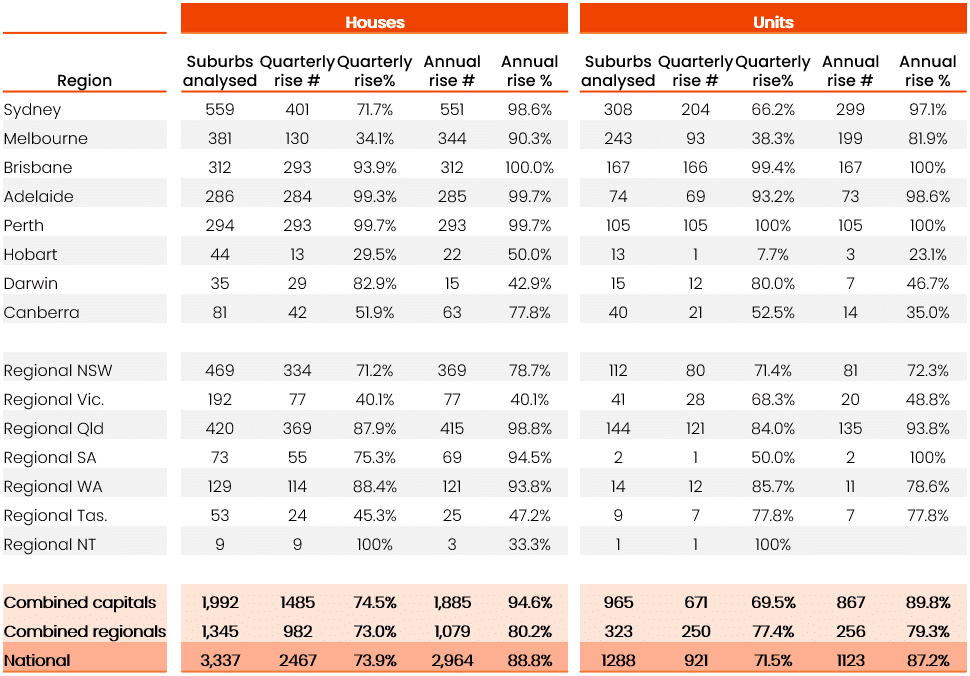

Our latest conversation revolves around the recent data released by CoreLogic, which has sparked excitement among investors and homeowners alike. This data confirms what we’ve been anticipating: the arrival of a significant boom in the real estate market. Breaking down the numbers, we see compelling evidence of widespread growth across various regions. In Sydney, an analysis of 559 housing suburbs reveals that 551 have experienced an increase in median value—that’s an astonishing 98.6% showing positive movement in the market. But the good news doesn’t stop there. Brisbane has achieved a remarkable 100% increase across all surveyed suburbs, mirroring this positive trend in Adelaide and Perth with 99.7% of suburbs also showing growth.

Insights from CoreLogic

Suburban Surge: Houses and Units Alike

The boom is not limited to the housing market alone; it extends to the unit market as well. In Sydney, 97.1% of the unit markets analyzed have seen a surge in value over the last 12 months. This trend is consistent across Brisbane, Perth, and Adelaide, indicating a holistic uplift across different types of real estate. The data unequivocally supports our prediction of the biggest boom ever witnessed, and it’s thrilling to see these forecasts coming to fruition.

Seizing Opportunities in a Booming Market

What does all this mean for you? It’s simple: the boom is here, and it’s time to act. This is the ideal moment to invest in real estate, whether you’re eyeing houses or units. Our advice is to buy what you can afford and to choose properties wisely to maximise your gains from this upward trend. Remember, these developments are occurring even before any potential decrease in interest rates, hinting at an even more favourable investment climate on the horizon. Talk to us and get started.