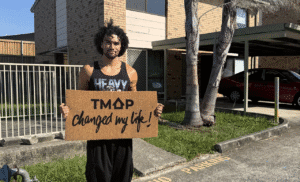

“Capacity, not desire, stops most families from buying property. Fix the inputs and lenders will meet you halfway.” — Massey Archibald, CEO and Founder of TMAP

Getting started in property looks hard because three challenges show up at once: know-how, money, and borrowing capacity. Add a fourth challenge called mindset, and many people decide to wait. TMAP students do the opposite. They turn each challenge into a worklist, then move.

Barrier 1: Know-How

Most families do not have a playbook. They feel lost on questions like structure, sequence, and lender policy. TMAP replaces guesswork with frameworks.

- The CAUSE Method guide the prep phase: Control, Action, Unity, Sacrifice, Education.

- TMAP2STEP sets expectations: buy what you can now, upgrade later.

- Market filters narrow the search: Capital growth, Affordability, and a Unique catalyst.

What to do this week

Map your timeline. Choose your Property Two-Step path. Book a call to translate goals into lender-friendly numbers.

Barrier 2: Money

People think the deposit is the whole story. It is not. Lenders want buffers, clean statements, and predictable inflows.

- Cashflow control: separate spending, bills, savings, and emergency buffer accounts.

- Debt clean-up: roll high-interest consumer debt, cancel unused limits, close zombie subscriptions.

- Evidence trail: three months of tidy banking beats a louder income.

What to do this week

Run a 90-day sprint. Lock accounts. Automate transfers on pay day. Print statements to check the story your money is telling a credit assessor.

Barrier 3: Borrowing Capacity

Capacity is the gatekeeper. Income, existing debts, living expenses, and lender policy decide the dose of money you can borrow.

- Income levers: overtime, second income, or business revenue with clean BAS.

- Expense levers: tighten declared living costs to lender benchmarks without lying.

- Debt levers: reduce limits before application so your score and capacity lift.

- Structure levers: use the Family Strategy when one member caps out.

What to do this week

Run a capacity review with TMAP Money (only available to TMAP Students). Model different lenders. Test scenarios with and without credit card limits. You will discover hidden room.

Barrier 4: Mindset

Many arrive with poverty game habits. Delay feels safer than action. Perfect feels safer than progress. The wealth game flips that script.

- Decide fast, refine later: perfect comes from reps, not hesitation.

- Avoid over-saving: targets must be hard yet sustainable.

- Stay in rhythm: routine wins. Consistency makes capacity.

What to do this week

Pick one daily wealth game habit. Fifteen minutes of market learning, or a nightly banking-app check. Progress becomes addictive.

Quick Wins TMAP Uses Early

- Credit refresh: fix errors, remove old addresses, close unused accounts.

- Statement polish: three clean months before lodging anything.

- Income proof pack: payslips, group certs, BAS if self-employed, all consistent.

- Valuable alternatives: if borrowing is tight, deploy cash into options, small developments, or SMSF strategies that do not need personal lending.

- Family Strategy: one brings deposit, another brings income, the occupant covers the repayment. Everyone wins.

Red Flags That Keep You Stuck

- Treating the first purchase like it must be the forever home.

- Chasing shiny strategies while abandoning the TMAP2STEP.

- Applying with messy statements and hoping the bank will “understand.”

- Waiting for rates to fall again while prices run away.

The TMAP Way To Start Strong

- Plan: choose market, price band, and product type you can actually buy.

- Prove: present lender-ready statements and documents.

- Purchase: execute the best asset at your price point.

- Repeat: recycle equity or apply the Family Strategy to keep momentum.

Want help turning barriers into a plan?

Join a TMAP webinar, book a discovery session, join TMAP, get your numbers modelled, and leave with a lender-ready action list. When the inputs change, approvals follow